Eng. Meshary AlAli AlDeheshi’s interview on Bloomberg and his talk about “Saudi mining”, the fastest growing in the world.. What are the incentives?

Saudi Arabia has recorded significant progress in the global assessment of investment risks in the mining sector issued by MineHutte, achieving the fastest global growth in the development of the regulatory and basic environment attractive to investments during the last 5 years.. More analysis with Eng. Meshary AlAli AlDeheshi, Chairman of Rasi Investment Company and CEO of Golden Compass Mining Services Company.

Watch the full interview on Bloomberg

Golden Compass plans to list its shares on the Saudi Stock Exchange in 2025

Meshary Al-Ali, CEO of Golden Compass Mining Services Company, revealed his company’s intention to offer its shares for public subscription on the Saudi Stock Exchange next year.

He pointed out in an interview with Al-Sharq, on the sidelines of the third Future Minerals Forum held in the capital, Riyadh, that “Golden Compass”, which specializes in the field of mining, especially exploratory drilling, as it has more than 40 rigs, aspires to be within the “TASI 50” index. For the largest Saudi companies after being listed on the stock exchange in 2025.

Al-Ali said it is likely that the mining sector in the Kingdom will witness a qualitative leap in light of the Ministry of Industry and Mineral Resources granting many licenses to companies for exploration, in addition to legislation, government support, and infrastructure, in light of the great demand from foreign companies.

The Chairman of Rasi Group participates with the Ministry of Investment in the Saudi Bangladesh joint Business Council meeting

The Chairman of Rasi Investment Group, Engineer Meshary Al-Ali, participated in the meeting of the Saudi Bangladesh joint Business Council meeting in Bangladesh, in the presence of Her Excellency the Prime Minister of the Republic of Bangladesh, Mrs. Sheikh Hasina Wajid and His Excellency the Saudi Minister of Investment, Mr. Khalid Al-Falih.

The meeting discussed the most prominent investment opportunities between the two countries and how to enhance them. It also discussed a number of workshops and meetings between Saudi and Bangladeshi companies on the sidelines of this visit.

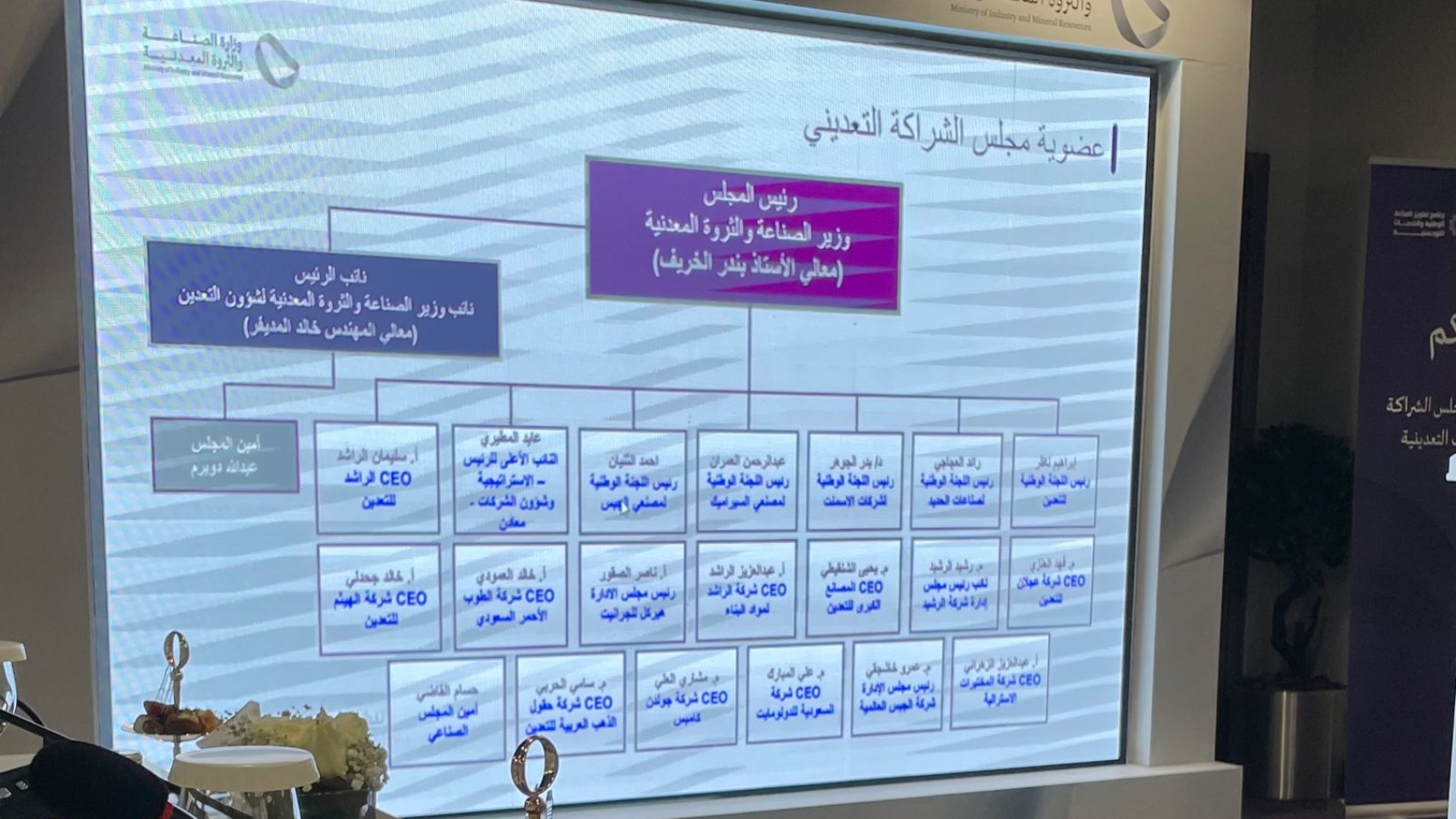

Chairman of Rasi Group, member of the Mining Partnership and Mining Industries Council

His Excellency the Minister of Industry and Mineral Resources Bandar bin Ibrahim Al-Khorayef chaired the first meeting of the Mining Partnership Council and Mining Industries, which reviewed the challenges of the mining sector that are being shared by the Mining Sector Committee, in the presence of His Excellency the Deputy Minister for Mining Affairs Eng. Khalid bin Saleh Al-Mudaifer and members of the Council.

The members of the council consisted of a number of experts in Mining sector, most notably Eng. Meshary AlAli, Chairman of Rasi Group and CEO of Golden Compass Company, in his capacity as a member of the council.

The official spokesman for the Ministry, Jarrah bin Muhammad Al-Jarrah, stated that the Mining Partnership Council aims to provide a channel that guarantees continuity of institutional communication between representatives of mining in the private and government sectors, in order to enhance the role of the private sector in raising the competitiveness of the mining sector in the Kingdom, and maximizing its contribution to the national economy. To achieve the sector targets set in Saudi Vision 2030.

Al-Jarrah indicated that one of the most important functions of the council is holding periodic meetings with the local and international private sector to ensure its active participation in the development of the sector, listing and evaluating the challenges received from the private sector, determining priorities for action on them, and submitting improvement proposals on sectoral policies and legislation in their stages of development to keep pace with global changes. Reviewing the strategies and initiatives referred to the Council and expressing views on them, reviewing international reports related to the mining sector and expressing views on potential development opportunities.

He stated that the council includes: representatives of the relevant national committees of the Federation of Saudi Chambers (the National Committee for Mining, the National Committee for Iron Industries, the National Committee for Cement Companies, and the National Committee for Gypsum Manufacturers), representatives of major national companies affiliated with the sector, representatives of mining services companies, and experts specialized in The mining sector, and a representative of the industrial council, adding that the tasks of the secretariat of the mining council are assigned to the secretariat of the mining sector committee, and the council establishes work teams and appoints a head for each team, approves the roles and tasks assigned to the teams, and names representatives of mining affairs in the ministry to work with each team.

Golden Compass projects revenue of $27mln in the current financial year

As Saudi Arabia begins a new age of mining, with untapped mineral deposits valued at over $1.3 trillion, there is a need for home-grown expertise in exploration, drilling and processing.

One company that plans to tap into this is Golden Compass, a Jeddah-based mining operator launched in 2016 focused on gold, limestone, copper and silica — which is used in a range of products, from microchips to solar panels.

Golden Compass has two main revenue streams: the identification and valuation of underground resources, and the actual mining and extraction of minerals.

Founder and chief executive Meshary Al-Ali began his mining career with a stint in Australia, before spending nine years at Saudi Arabia’s Ma’aden — the largest miner in the Gulf region — where he was ultimately promoted to senior project engineer.

Al-Ali said he resigned from Ma’aden to establish a startup that will “be the biggest mining consulting and services company in Saudi Arabia in the first phase, and in the Middle East in the second phase.”

Beginning with a small team of geologists and mining engineers, Golden Compass has expanded to 120 staff.

Its first successful investment round came in 2018, bringing in the Saudi venture capital firm Naif Al Rajhi Investment Group. The size of that deal remains confidential, but it gave NRI a majority shareholding, and shortly afterwards, NRI injected a further SR20 million ($5.3 million).

In 2020, 10 percent of Golden Compass was bought by Saud Al Rajhi Investment Group (NRI and Saud are both part of the Al Rajhi banking dynasty) for SR7 million, valuing the company at SR70 million.

A third investment round is currently being finalized, the details of which are again confidential, with an Initial Public Offering slated for 2028.

Al-Ali told Arab News that the need for such levels of investment stems from the amount of equipment required in the mining sector.

“The big mining companies don’t necessarily want to invest their capital in rigs and drills and bulldozers, which are expensive, and which also depreciate quickly,” Al-Ali said.

He added: “If you are a multinational mining company that wins a concession for a gold or copper mine in Saudi Arabia, you will usually not run it yourself.

“You’ll contract that out to a certified operator specializing in exploration, resource and reserve estimation and core cutting — and with its own fleet of rigs, bulldozers, drills, processing facilities, laboratories, and of course manpower. And all of that requires huge capital investment — over SR 50 million so far, in our case.

“We carry out exploring, surveying, blasting, extracting, drilling — the entire circle of operations. We’ve become a one-stop shop of services for mining companies.”

The company is on a rapid upward trajectory, with revenues of SR30 million in 2020, and SR27 million in 2021, a fall partly due to management changes in their primary client Ma’aden, causing a delay in the closing of a contract. However, Golden Compass projects revenue of SR100 million in the current financial year.

“Saudi Arabia’s mining sector is booming”, Al-Ali said. “This really started with the new mining code on 1 January 2021. Saudi Arabia is now marketing its mining industry to the world and wants to bring in more global players.

“How? By enacting a very solid law that will protect the investments of foreign companies and provide easy access to information and data — for example via the National Geological Database and mapping program, which is updating a lot of redundant historical information.

“International mining companies now have a very solid law to protect them, and a good business environment in a stable country with confirmed mineral reserves — and the Saudi government now supports mining companies with 70% finance. So, it’s a total package.”

Another important new initiative is Saudi Arabia’s accelerated exploration program, where the Kingdom’s Ministry of Industry and Mineral Resources seeks to “motivate and encourage small-scale exploration companies.”

Golden Compass has bid for some of those contracts and the winners will be announced later this year.

Mining has three phases. Upstream consists of exploration and extraction. Midstream is made up of processing. And downstream is the manufacture of finished products.

“Until now, over 80 percent of Saudi Arabia’s mining sector has been concentrated on upstream”, Al-Ali noted. “But the object now is for the country to be involved in the entire value chain.”

He said one way this can be achieved is by setting up factories that process the Kingdom’s abundant silica into solar panels, with the transfer of technology and knowhow, along with the potential creation of many jobs.

“Saudi Arabia needs to diversify its income over the next 20 years,” Al-Ali said. “I think that the leaders of our mining industry are on the right track, and are building a healthy and sustainable and transparent system for investors and mining companies.”

The Golden Compass Company signs deals worth $133 million

RIYADH: Saudi Arabia’s mining firm Golden Compass signed contracts worth SR500 million ($133 million), according to its CEO.

The contracts related to Mining operation, drilling, and mining and exploration consultation, Meshary Al-Ali told Arab News.

Saudi Arabia’s has a very flexible and very transparent system, and it’s one of the most powerful in mining around the world, Al-Ali added.

Saudi Arabia has issued a new minig law to attract investment this year. Investment interest in Saudi mining has skyrocketed this year 2021, Khalid Al-Mudaifer, vice minister for mining affairs at the Ministry of Industry and Mineral Resources (MIM) told Arab news last month.

The ministry issued 133 local exploration licenses, and there are applications for international exploration that are under processing, Al-Mudaifer said.